When you’re running a business, every penny counts. Paying employees fairly and on time is essential to an organization’s health, but factoring in payroll can be a time-consuming process. As you weigh your options, you may wonder if free payroll software is the way to go.

Compare Top Payroll Software Leaders

Since 82% of failed companies met their demise because of cash flow problems, according to SmallBizGenius, it’s clear that your tech can make or break you. It’s only natural to look at the most affordable option. With that in mind, let’s look at free payroll software.

In this guide, we’ll address the following questions. Can you do payroll for free? Is there any free payroll software? What is the best free payroll software for small businesses? Keep reading for all the answers.

What’s in This Article?

- Needs Analysis

- FAQ

- Pros and Cons

- The Best Free Payroll Software

- Alternatives to Free Payroll Software

- The Final Word

- What Do You Think?

Needs Analysis

Before evaluating any piece of tech, it’s essential to set your priorities straight. A company of five won’t have the same HR challenges as one of 50. Each business has different challenges. Still, this list of crucial requirements is an excellent place to start.

Here’s what you should keep in mind when deciding if a free payroll software solution is right for you:

- Core HR: You’ll need HR capabilities to facilitate an effective workforce. HR processes may include benefits administration, performance management, employee demographics, database management and more.

- Payroll Administration: To run the organization’s finances, you’ll need something that handle forms, calculate deductions and tax rates, file taxes, operate direct deposit and meet other financial requirements.

- Scheduling: It’s essential to keep butts in seats when you absolutely need them. That’s why some platforms offer scheduling, time and attendance, PTO and leave requests.

- Compensation Admin: To attract and keep top workers, you’ll need a thorough understanding of fair compensation. Some solutions offer tools to help ensure your workers are getting paid fairly.

- Taxes: Make sure your platform can do essential work such as calculating deductions, tax rates, benefits and other functions for state, local and federal taxes.

- Reporting: Look at reporting and analytics functions so you can analyze trends, financial reports, budgeting and even deliver employee surveys.

- Compliance: If compliance is vital in your industry, look for automatic compliance and the ability to generate reports for 401(k) and the EEO, EEOC, HIPPA and other organizations.

Want to learn more about evaluating solutions? See our full article of payroll software requirements.

Select the Right Software with the Free Lean Selection Book

FAQs

Why do I need payroll software?

Payroll systems take the weight off a business owner’s shoulders regarding the daunting tasks of tax filing, customization, synchronizing HR and much more. Not paying particular attention to payroll can result in a loss of employees and a jumbled mess of paperwork. Investing in software can save your company time and money while also you care for your people.

When should I invest money in payroll software?

Clearly, there are some great benefits available via free payroll software tools, especially the free part. However, it won’t always be the best option for every company.

Consider upgrading to a paid service when:

- You expect your amount of employees to increase quickly.

- You need more internal support for potential issues.

- There aren’t enough customization options available.

- The features given don’t provide exactly what your company requires.

- You can fit it in your budget.

What if I don’t want to use payroll software?

If using paid-for or free payroll software doesn’t seem to be the best option for you, that’s fine. But be aware of the potential manual labor challenges and time constraints that may present themselves. You’ll have to know and understand all tax laws to prevent any unnecessary IRS headaches down the road. Be prepared to conduct your own calculations as well. Luckily there are resources available to assist you, such as free payroll templates and Excel spreadsheets.

Get our Payroll Software Requirements Template

Pros and Cons

Now that we’ve gone over the best solutions, it’s time to ask a question. Is free payroll software truly the best for your business? There is no absolute right or wrong answer. What’s perfect for one company could be a nightmare for another. It’s necessary to have a long conversation about whether free payroll software will work for you.

Here’s what you should consider:

Pros

Low Cost

What’s the best thing about free payroll software? They’re free, of course! It’s hard to get a better price than that. According to business.com, online payroll services typically charge $29 to $150 base fee, plus $2 to $12 per employee. If you do the math, it can add up quickly and become an expense some companies can’t afford.

Frees Up Staff Time

Doing manual calculations for money matters can dominate the time of accounting staff. This makes it hard for them to do much else. The NSBA reports that one-fifth of small business owners spend six or more hours internally on payroll per month. If they have five or more staff members, that amount jumps to one-third.

Better Employee Retention

Payroll solutions make hiring much faster. Having a streamlined onboarding process means losing fewer new hires. When they feel well trained, they’re more likely to stay. According to CareerBuilder and SilkRoad, 93% of employers were unanimous in accepting that a good onboarding experience is crucial for new employees deciding to stay with the company.

Do I Really Need More?

Before buying any platform, it’s always a good idea to go in with a plan and make a checklist of necessary features. Now cross-reference that list with the capabilities of free payroll software. Did you get everything you need? How much money do you spend doing payroll compared to the cost of implementing a robust payroll solution? Small businesses may not need more than what a free compensation platform has to offer. In that case, why pay when you don’t have to?

Cons

Not Complex Enough

On the flip side, larger companies need more detailed processes. Free payroll software might not fit their challenges. Again, it’s crucial to create an implementation plan beforehand to ensure that nothing vital is missing from the list.

Lack of Customization

An inefficient workflow with bottlenecks and inadequate support is a serious problem. According to Business Efficiency for Dummies, having inefficiencies can cost an organization between 20% to 30% of its revenue per year. That’s why companies with a unique workflow, industry complications or other issues that don’t conform may need something special a free payroll software option may not offer.

May Not Integrate with Legacy Programs

Depending on the solution and nature of your pre-existing legacy programs, there could be inherent complications. The 2019 State of Ecosystem and Application Integration Report found that businesses lose $500,000 a year to integration problems. It’s crucial to thoroughly audit any software that needs to communicate before selecting a new one.

Difficulties Scaling

No one enjoys reinventing the wheel. What happens if your industry jumps from 10 to 50 employees in the next year? Will your solution be able to handle that? Around 50% of new businesses fail within the first five years, reports the U.S. Bureau of Labor Statistics, and scaling is one of the biggest reasons.

Lack of Consultation Services

Some companies need more than just software. If you don’t have the staff, the skills or the resources, completely outsourcing everything might be a better option. Not only will they make sure your organization is compliant, but they’re also likely to find deductions and save money.

Best Free Payroll Software

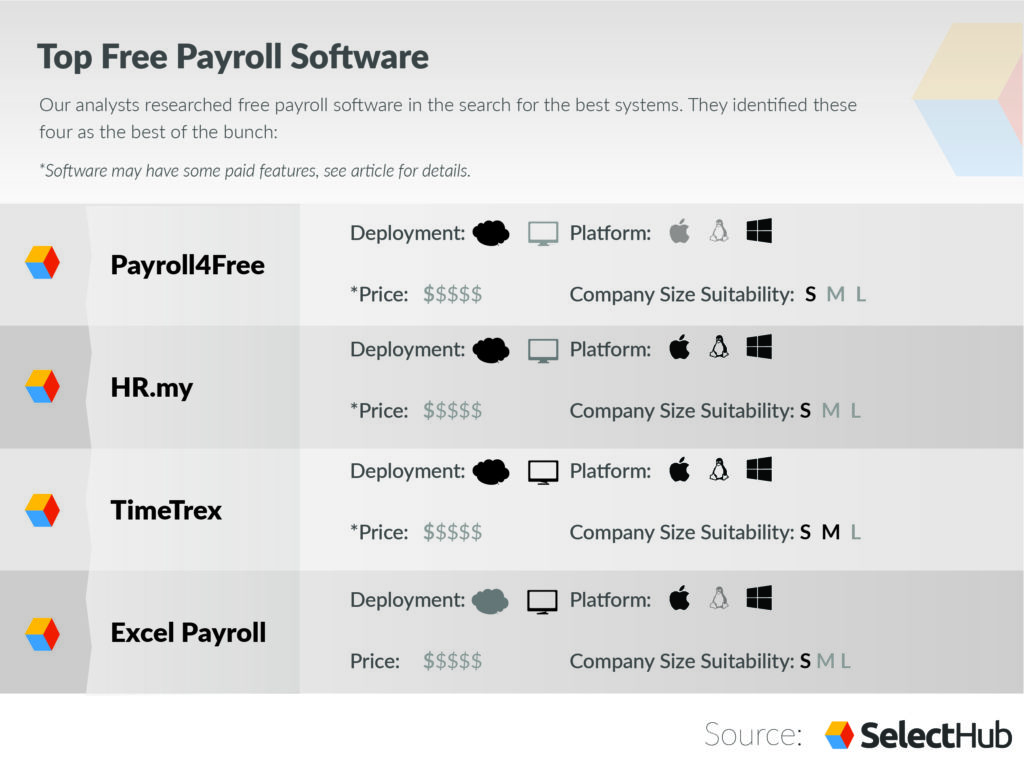

Without further ado, let’s get to it. Today we’re looking at Payroll4Free, HR.my, TimeTrex Community Edition and Excel Payroll, each chosen after our in-depth research. Keep reading to see what these free payroll software solutions offer, their pros and cons and how they stack up to others.

Payroll4Free: Best For Overall Payroll Management

Payroll4Free provides free online financial services to small businesses with 25 or fewer users. Its capabilities include compensation processing, vacation tracking, tax forms, HR assets, reporting options and more. It also provides live customer support, handles direct deposits for workers using their personal bank and integrates with other solutions.

Limitations

In terms of limitations, it doesn’t have any 401(k) tracking, it’s free only up to 25 employees and only runs on Windows OS. However, Macs can run it with a Windows OS installation.

Payment Info

You may wonder, is Payroll4Free actually free? The answer is yes, but there are two paid services. They are:

- It files and deposits taxes for $12.50 per month.

- Workers can use a bank provided by Payroll4Free to transfer direct deposit funds for $12.50 monthly for a max of $25 per month.

Employee Use

Your workers can log into their portal from any device to review vacation time, reprint pay stubs and W-2s and update their information. It’s also easy-to-use with a step-by-step account setup tool for enrollment.

Payment and Taxes

Payroll4Free handles payroll management and tax administration. For compensation, it pays employees and 1099 contractors. It can calculate on the user’s behalf and do the end of the year processing for state, federal and local taxes for a monthly fee.

Administrative Functions

Keeping track of PTO can be a headache. Payroll4Free calculates and tracks vacation hours. It also manages PTO, sick leave and tracks the amount of paid leave earned for each hour worked. HR officers and other designated users can customize the information and print employee payslips. Last, it pulls reports for taxes, benefits, earnings, accrued time, financial journal entries and more.

Other Features

Payroll4Free can export data to banks, accounting, benefits companies and data from time clock platforms. It’s secure with 2048 bit SSL encryption and data stored on Amazon Cloud. The one downside is that it doesn’t protect saved passwords and form data on browsers. Users will want to find a well-regarded extension to protect browser info.

Platform:

Compare Payroll Software Pricing & Costs with our Pricing Guide

HR.my

HR.my is a cloud-based solution that offers HR, leave and payroll management. It automates financial processing with auto-created payslips for employees and processes monthly, semi-monthly, weekly, and bi-weekly. Some capabilities include time and attendance, document workflow, expensive claims and document sharing. It supports many languages, multiple users online at once and can export data anytime.

Built by Users

If you’re a customer of HR.my, you can request new, free capabilities. The community crowdfunds this solution, so it answers directly to its users. In fact, many new features were added because of a fan request.

Payment and Limitations

In terms of price, it’s free payroll software with no paid features. However, some functions get reserved for sponsors. Some downsides include:

- A lack of specific customizations for the U.S.

- An inability to facilitate wage garnishment or 401(k) tracking out of the box.

- There’s no mobile app, but users can review and manage expense claim applications from smartphones.

Workflow Management

Each manager can add unlimited employees with individual accounts and set up workflows for different groups. Through assigned roles, workers can manage HR functions. It’s available for Mac, Windows and tablets. It streamlines the process by sending applications and claims submissions to department and branch heads. Most importantly, it logs application workflows to create an audit trail.

Employee Use

Through the self-service dashboard, workers can check their pay stubs, submit claims for expenses, look at historical records and see their application status from their account. If needed, workers can attach documentation for expense claims and leave applications. They get notified for each new application and status change for their application.

HR.my provides a worker discussion board so management can listen to feedback on various company procedures or policies and send out surveys. The solution also helps employees keep up on credentials with education, training and tracks legal documents.

Attendance

With geolocation from Google Maps and the ability to take selfies, organizations can track overtime, attendance, tardiness and more. Hours can be auto-calculated and the system generates monthly attendance reports.

PTO and Availability

Management can control and approve employee leave applications and paid time off, access historical records, look at monthly leave statistics, see days off and check schedules in the same department or over the whole organization. To make communication clearer, coworkers, branch heads and department heads can see availability to make educated decisions.

Communication

You’ll get alerts about expiring contracts, probation ending, work permit expirations, birthdays, job anniversaries, job reviews and more. It’s also possible to send out announcements and notifications to all employees. This helps everyone stay up to date and get to events.

Document Management

The system can maintain a content library. It migrates paper documents into the system. This includes expense claims, timesheets, overtime requests or purchase requests. It enters all of them into the document workflow.

Users can also share forms such as company policies, employee handbooks, SOPs and more. They can also submit reports for manager reviews or send disciplinary letters. They can also print and manage leave transactions, attendance, time clock and payroll data. Last, it can export to Excel.

Security

It’s encrypted with SSL (TLS) protocol, secured with daily off-site backups and data exports, has privacy protection with no third-party allowed to access data, hashed passwords and restricted permissions to certain info for workers

Platform:

Company Size Suitability: S M L

Compare Payroll Software Pricing & Costs with our Pricing Guide

TimeTrex

TimeTrex Community Edition is open source and facilitates the payroll, scheduling and time management for up to 200 employees. Rather than being run corporately, it’s supported and developed by volunteers from more than 50 countries. That means it depends on user support.

The Community Edition of the software is free. However, there are paid TimeTrex options with more functionality. Key features include direct deposit and payroll calculator for local, state and federal income. It also handles deductions for garnishments, benefits, garnishments, vacations and sick times. Users can generate pay stubs for viewing or print out.

Limitations

In terms of limitations, it’s important to know that the Community Edition doesn’t support mobile devices, can’t import punch data from MySQL database, doesn’t support a shared hosting environment and won’t offer web quick punch or facial recognition tablet time clock.

Recruiting and Employee Qualifications

TimeTrex has a wide range of recruiting abilities. It tracks and manages worker qualifications, skills, proficiencies, education, memberships, licenses, languages and personal info. It can centralize data like contact info, personal details, profile picture, emergency contacts, dependents and more.

Applicant profiles include their availability, resumes, job history, ID and past mailing addresses for background checks. They can apply to one or more positions without entering all that data again, and company reps can post jobs for internal or outside candidates. It handles the recruiting process from start to finish.

Scheduling

It has automation for schedules and lets workers see and sync their schedules from mobile devices. Employees can also submit PTO/vacation requests, which are authorized securely from anywhere.

TimeTrex includes scheduling, time and attendance software.

Attendance

Users can track attendance in real-time and follow sick days, vacation or banked time. Management can control where workers punch in or out. The system handles scheduling and attendance in the same system, streamlining the process.

Payroll Management and Taxes

It integrates with ADP, Dayforce, QuickBooks and SurePayroll. It provides various tax and other government reports, such as W-2s, W-3s, 940s, 941s and 1099s.

Other Features

- Document Management: Users can attach documents to jobs, clients, worker records and view them from anywhere.

- Performance Reviews: It enables and standardized performance reviews for employees, tracks accidents and facilitates entrance/exit interviews and discipline.

Platform:

Company Size Suitability: S M L

Compare Payroll Software Pricing & Costs with our Pricing Guide

ExcelPayroll

ExcelPayroll is precisely what it sounds like. Four Microsoft Excel files work together to provide the user with compensation management functions. It’s free, provided you already own Microsoft Suite. All you have to do is download it from the ExcelPayroll website.

Some of its key functionality includes printing W-2, W-3, 941 and DE-9 forms. From there, it can compute the tax liabilities. It also processes 401(k)s, 125P,s HDAs, garnishments and more. Last, it calculates info for workers’ compensation reports and vacation time.

Limitations

Since it’s run on Excel files, users need to self-host or put it on a shared drive. It’s not a true Software-as-a-Service. There’s an email for site issues at ExcelPayroll@gmail.com, but that’s the extent of the customer service. Crowd-sourced answers can also help. While it can compute taxes, it won’t file them. It’s also worth nothing that this includes a lot of manual information entering, which takes a significant amount of time.

Parameters

It’s free to download and use. Computers must have Excel version 2007 and to run it and at least 10 free megabytes on the hard drive. It can support up to 200 workers, but active employees can’t be over 57.

Payroll Management

Through ExcelPayroll, users can make batch payments and select and compute weekly, bi-weekly, monthly, quarterly or annual pay periods. When workers switch in mid-year, they can convert their old manual program. It can enter any date for a payroll check so payroll liabilities occur on the same date as check dates. Users can redo/reprint old records for back years.

Checks

It provides check formatting for Great Plains, Peachtree, Platinum, QuickBook, Quicken, SBT and self-design check formats. Employees can select, print and design layouts and make adjustments if print-outs don’t match the check position.

Benefits and Deductions

The solution covers four different deductions. They are:

- 401(k): A pre-income exemption on federal and state taxes

- Partial Tax Exemption: A health savings account or similar contributions

- Post Tax Deduction: This happens after taxes and includes garnishments, loan payments and others.

- All Deductions Types: This means income, FICA and local and FUTA and SUTA.

It also covers vacation time earned by the workers.

Taxes

There are special, detailed instructions for how to select employees while printing W-2 and W-3 forms. It can print worker copies, IRS red copies and other necessary copies for W-2s. Carefully read instructions before printing.

Time Cards

The timecard option allows people to track job costs, record hours for each job and keep a history of time cards. ExcelPayroll has four separate sheets for the Timecard File. This includes:

- Timecard Sheet: Users can enter the hours for each employee.

- JobList Sheet: This optional sheet allows workers to enter the job list and record costs.

- LaborType Sheet: Users can enter labor type and keep track of the costs of hours on the job. Also optional.

- EquipmentType Sheet: This last optional sheet lets employees enter equipment type and track equipment hours.

Platform:

Alternatives to Free Solutions

If you decide that free payroll software platforms aren’t meeting your needs, it’s time to look at paid options. Full-service HR software offers both payroll and a range of administrative functionality. Here’s a list of a few solutions that could work for an organization looking for something more all-inclusive.

Best Paid Solutions

Paycom

This full HCM suite covers financial issues essential to HR tasks, management, talent acquisition, time and labor and other functions for small to medium-sized businesses. Paycom’s tax capabilities help with calculating and preparing annual tax documents, filing payroll tax and integrating pay data to help manage compensation.

One possible paid solution.

Paylocity

Paylocity is cloud-based, good for all-sized companies and comes with a user-friendly mobile app. It facilitates payroll processing, vacation and time-off requests, taxes and provides real-time use. HR professionals can also create templates for info on demographics, deductions, earnings and direct deposit.

ADP Workforce Now

Another HCM solution, ADP Workforce Now offers compensation, HR capabilities, benefits and talent management. Users can export reports into Excel. Through the integrated general ledger system, everyone can access financial journal entries easily. If you just want payroll capabilities Run Powered by ADP is another solution.

UltiPro

A full-service HR platform, UltiPro offers core HR assistance, benefits administration, onboarding, payroll processing and more. It also uses AI so HR workers get insights that help drive worker engagement.

Gusto

A solution designed for small- and medium-sized businesses, Gusto automates and calculates tax filing for local, state and federal taxes. It can use e-signatures to speed up processes and integrate with time tracking, accounting, banking partners and POSs.

Other Options

Check out our full breakdown of the best full-service payroll systems and how they match up.

Software with Free Trials or Benefits

If a specific focus on your payroll is the right move for your company, here’s a quick rundown of a few other solutions. Some of them have free benefits, allowing you to use them in some capacity. Others offer free trials. By submitting to a trial for a few weeks or a month, it allows you to get more experience with how well something works, how it integrates with systems and lets you scout out other problems before it’s too late.

CheckMark Payroll

It offers compensation management, accounting, ACA reporting, filing for 1099s, checks and envelopes. The platform has four different assets, each ranging in price. A free trial is available.

eSmart Payroll

This limited solution files forms and taxes online such as 1099-MISC, 940, 941, W-2 and more. It files PIN applications for 941, 940 and 944 forms free. For other filings, the price varies per individual form.

SurePayroll

Software for small businesses, accounts, HR and nanny finances. It offers multiple pay rates, unlimited payroll, direct deposit, deductions, benefits and new hire functions. It comes with a free, one-month trial and a free financial calculator.

Wave

This platform handles bank and credit card payments, taxes, payment for independent contractors, invoicing and more. Certain accounting, receipt scanning and invoicing features are free. It has a 30-day free trial.

WebHR

This full-service HR solution has several capabilities such as payroll processing, direct deposit, check printing and others. It has a complete range of HR functions. It’s free for companies with five or fewer users.

Screenshot from WebHR.

Zenefits

Zenefits helps with HR, payroll, PTO, onboarding, benefits, org charting, integrations and time and attendance functions. It comes with a 14-day free trial. After that, pricing is per employee.

Other Affordable Solutions and Resources

If you’re looking to calculate a few specific formulas and don’t need or have money for a full payroll system, it’s a quick and easy solution. Paid software often offers calculators for free. They can calculate state or federal tax rates, per diem or other shortcuts.

Free Payroll Calculators

- eSmart Paycheck: A free payroll tax calculator.

- Fingercheck: Tax calculator.

- OnPay: A payroll and tax calculator with tax rates for each state.

- Paycheck Manager: Another free tax calculator.

- Per Diem Rates Calculator: From the U.S. General Services Association.

- SurePayroll: A small business payroll calculator.

Free Payroll Newsletters and Websites

It’s critical to keep up with the latest industry news to avoid running into compliance or law changes. Proactive companies want their workers to be well-educated and able to be proactive with their solutions. Here are a few newsletters, websites and wires professionals need to succeed.

- IRS Newswire: Two to three press releases per week covering changes in laws, filing season updates, tax admin and more.

- E-news for Small Business: Free information covering tips for tax compliance, reminders of upcoming filing dates and IRS news releases.

- E-news for Payroll Professionals: It covers special announcements, recent legislative changes, new employment procedures and more for financial employees.

- IRS Guide Wire: Covers guidance straight from the IRS on revenue procedures, revenue rulings, announcements and notices from the IRS.

- American Payroll Association: It provides resources for both members and nonmembers, including educational materials, compliance info, news and conferences.

- EEOC Homepage: News, information and resources from the U.S. Equal Opportunity Employment Commission.

- Social Security Website: Provides news and information on changes to social security.

- U.S. Department of Labor: Contains labor news, information and other assets from the labor department.

Compare Top Payroll Software Leaders

Final Word

For large enterprises, free payroll software is rarely a good option. They often lack necessary requirements, customizations, complexity and capabilities to handle large business operations. In that case, a paid payroll software service or even a full-service HR software solution may be the right choice.

However, for small organizations operating on a shoestring budget, free payroll software may be the way to go. Payroll4Free offers basic compensation and tax administration, can export data to other companies and has encrypted data. However, it only runs on Windows OS. HR.my has many payroll administration features, is crowdfunded and adds new features upon user request. However, its mobile capabilities are limited and it has no mobile app.

TimeTrex Community Edition offers attendance, recruiting and scheduling in addition to compensation management but can’t import data from punches that come from a MySQL database. Lastly, ExcelPayroll is made from four excel files linked together. For companies that already own Excel, it’s an affordable solution, but it doesn’t file taxes and takes a lot of time.

Before selecting anything, the most critical step is figuring out the core functionality you need for your company and what is your highest priority. Going through a list of requirements and crafting an implementation plan is a must.

Free payroll software could be the perfect answer, but don’t cut corners. Keep your eyes on the priorities so you and your employees can get paid and thrive.

What Do You Think?

Have you used any of the free payroll software platforms we listed? What was your experience? Do you like or dislike these solutions? Are there any great platforms we missed? Leave us your comments below!